UPDATE: MINISTRY OF FINANCE OF UKRAINE

Oktober 21, 2022

CORPORATE GOVERNANCE INDEX UKRAINE 2021

April 26, 2023

CORPORATE GOVERNANCE INDEX UKRAINE 2020

INTRODUCTION

This is the second edition of the Ward Howell Ukraine Corporate Governance Index, an annual study designed to identify the current status and the trends of the corporate governance in Ukraine.

Our purpose is to provide business leaders with a snapshot of current patterns of boards in Ukraine, including board size and composition, board committees, as well as portraits of the Chairman and the CEO. This is the first year we have had the chance to compare this year’s data to the previous year’s data. Much more interesting, 2020 was affected not only by market developments but also of the COVID-19 pandemic.

We value the feedback received from our readers regarding the Ward Howell Ukraine Corporate Governance Index 2019. We have tried to take into account your ideas and opinions.

We hope that you will find this research paper a valuable and practical source of ideas and insights. We welcome your feedback and the opportunity to discuss any of the issues that arise from our research.

METHODOLOGY

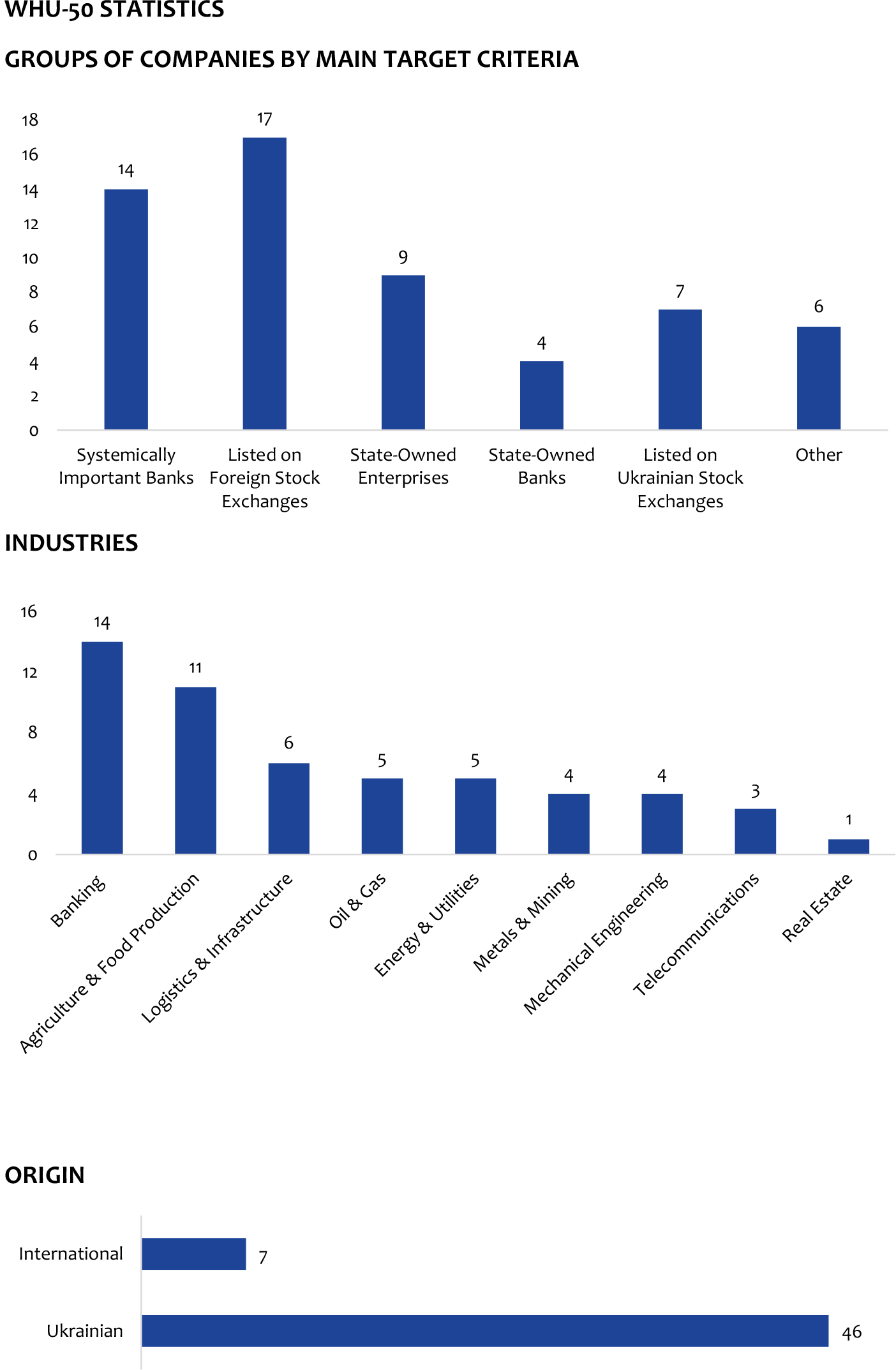

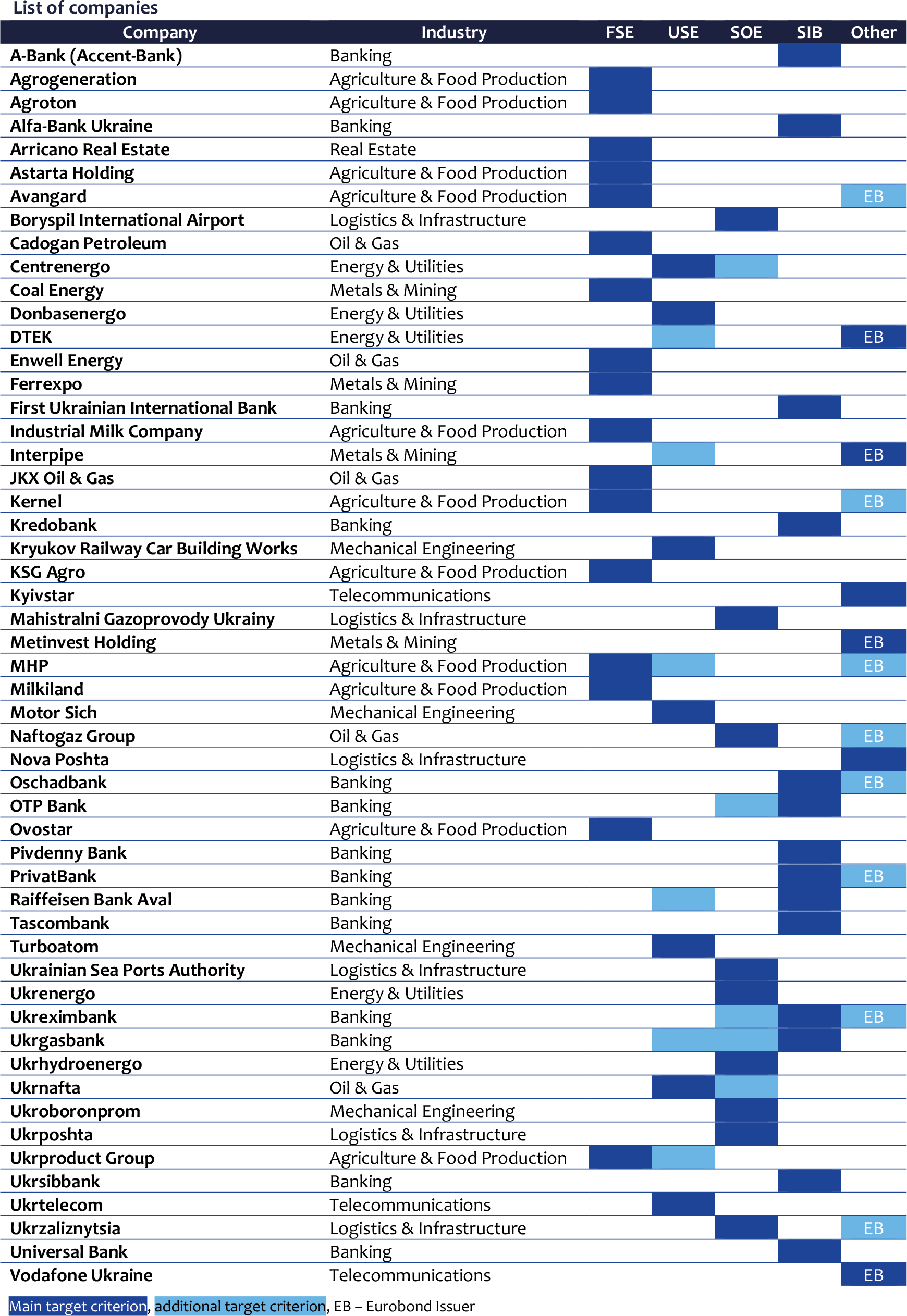

WHU-50

WHU-50 is an annual list compiled by Ward Howell Ukraine presenting the Ukrainian companies that are the leaders in corporate governance development. Based on market developments in Ukraine and our readers’ feedback, we have expanded our list from 50 companies to 53 companies. This year’s Index includes five new companies (Arricano Real Estate, Cadogan Petroleum, Coal Energy, Kyivstar, and Nova Poshta) while two companies (Dragon Ukrainian Properties & Development and Ukrlandfarming) had been omitted from the list.

Therefore, in 2020 we studied 335 board members at 53 companies of the WHU-50 compared to 323 in 2019.

The list, which can be found on the page 26, includes the following groups of companies, for which information about corporate governance systems is usually publicly available:

Sixteen companies on the WHU-50 meet two or more of the above target criteria. To assure the greatest possible accuracy of the data, the following definitions should be taken into account when analyzing the results of the research:

Unlike the well-known indices of stock exchanges and business magazines, which are strictly rule-based, the components of WHU-50 Index have been selected by Ward Howell. When choosing the list of companies, Ward Howell assesses the company's merit using several primary criteria:

This index does not include some private Ukrainian companies which have well-developed advisory boards but on which information about the boards of directors is not publicly available.

Because each year more companies are becoming transparent, the list is not static and is continuously changing.

Data sources and definitions

We gathered all the publicly available data from the 53 companies’ websites and official documents, including but not limited to:

All data were taken as of December 31, 2020. In the few cases when such information was not found in the documents listed above, the data were taken from the most recent and relevant documents. The list of systemically important banks was taken as of March 5, 2020.

Our research focuses mostly on gathering numerical data and constructing statistical models to reveal the patterns of corporate governance in Ukraine.

A company’s country allocation in the WHU-50 is based on initial incorporation along with market perception. We define international companies as those in which foreign citizens hold the majority of shares. We define foreign professionals as being of different nationality from Ukrainian. New members of the board are those who were appointed for the first time in 2020.

By the term “board” we mean either the supervisory board as in a two-tier system or the board of directors as in a one-tier system. The management board is identified as such.

List of abbreviations

FSE - Foreign Stock Exchanges

Max - Largest number among the research subjects

Min - Smallest number among the research subjects

Q1 - Lower quartile – the point at which one fourth of the data are less than or equal to that point.

Q3 - Upper quartile – the point at which one fourth of the data are larger or equal to that point.

SOB - State-Owned Bank

SOE - State-Owned Enterprise

USE - Ukrainian Stock Exchanges

RESULTS

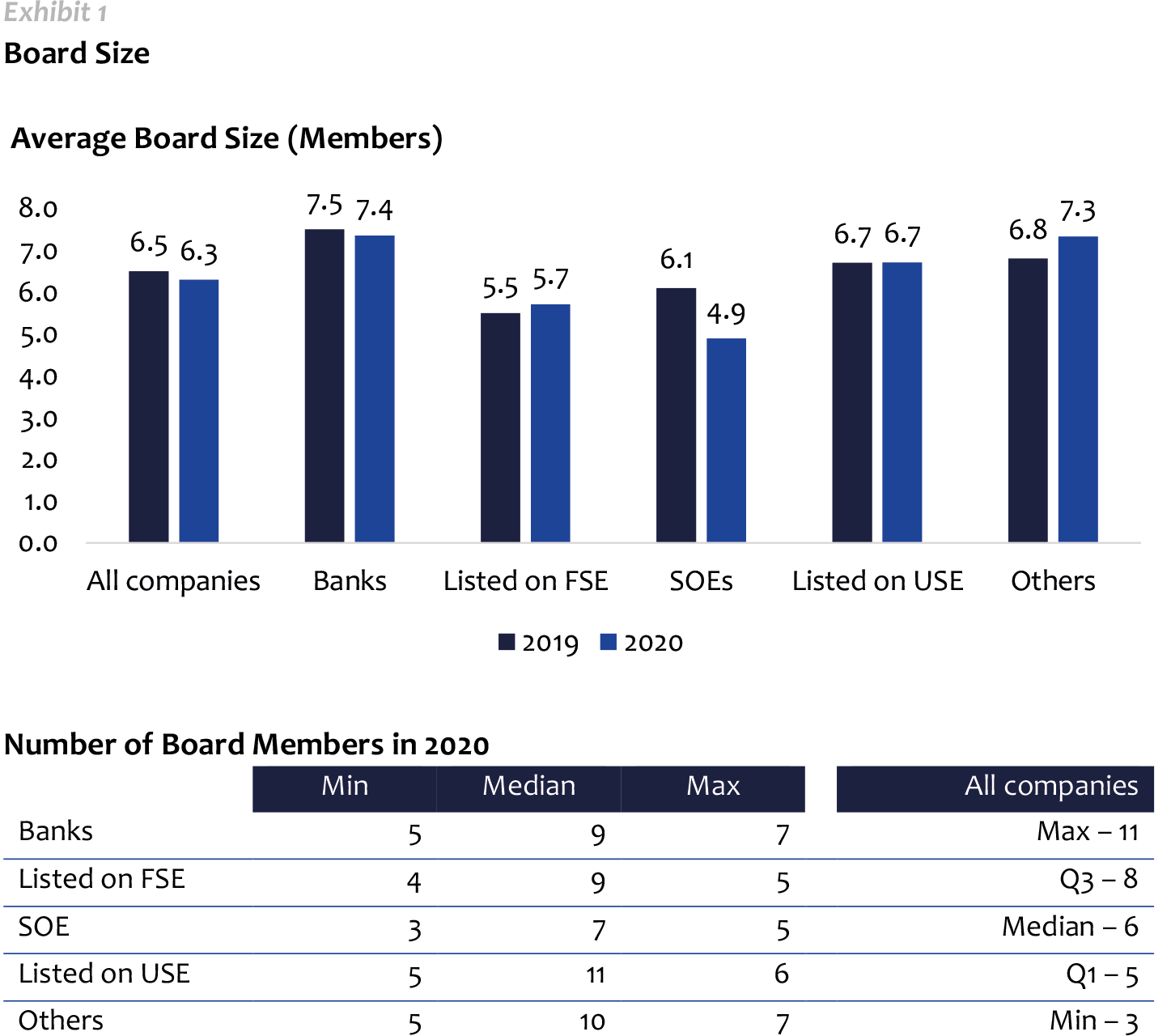

Board Size

The average board size across the WHU-50 in 2021 is 6.3 board members, a slight decrease from 6.5 in 2019. This includes both independent directors and shareholder representatives. Board size range remains from 3 to 11 board members.

Banks have the largest boards while the smallest boards tend to be found in the companies listed on foreign stock exchanges and in the state-owned enterprises. Among 48 companies which were included in both the 2019 and 2020 board indexes, 7 companies increased, and 10 companies decreased the number of board members.

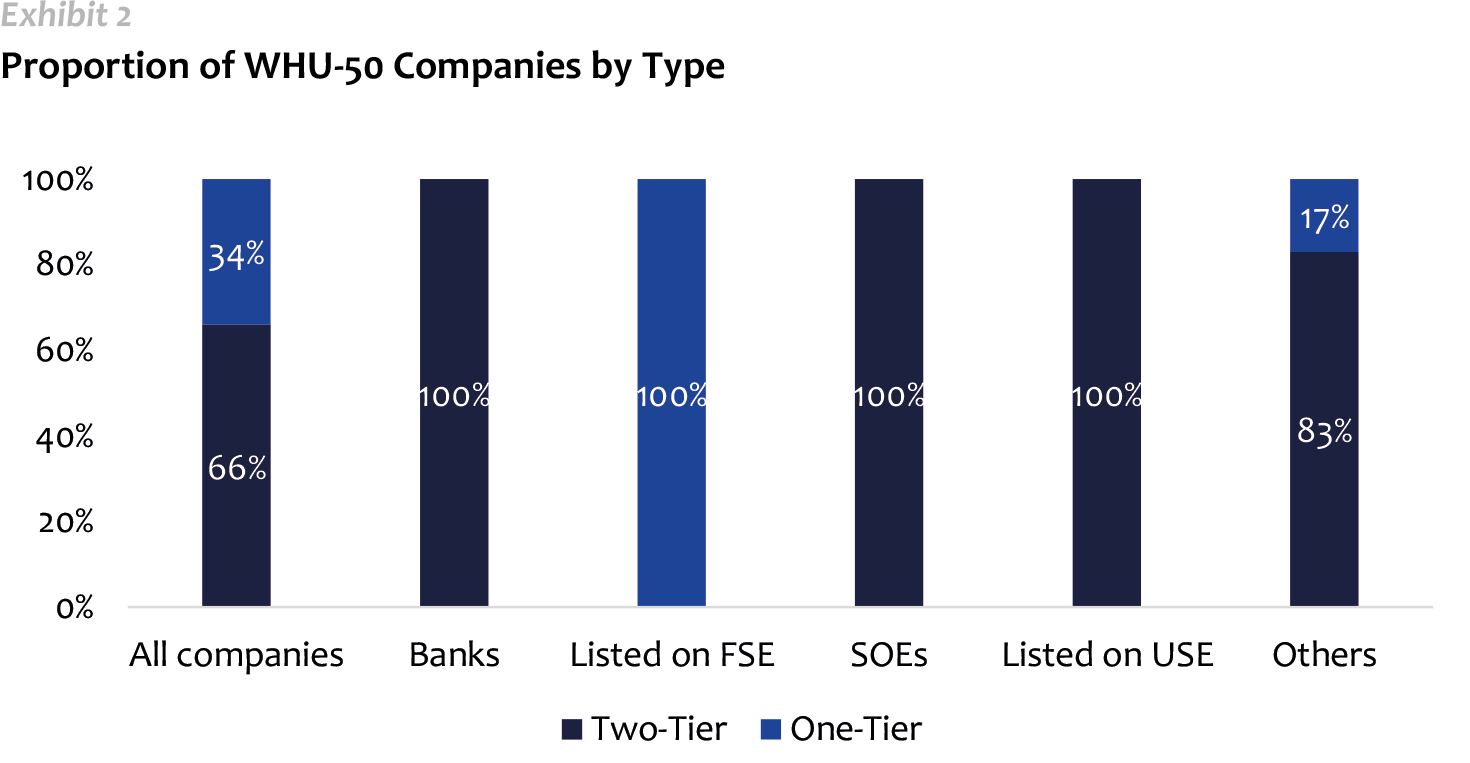

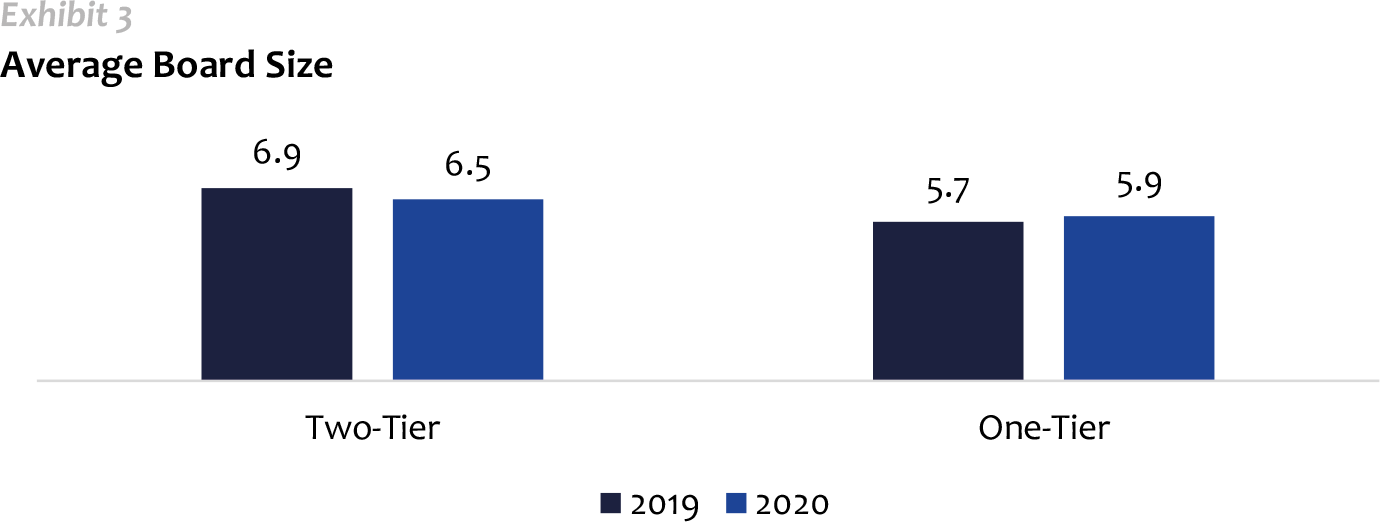

One-Tier vs. Two-Tier Boards

There are two types of board structures: the one-tier board (also called a unitary board) and the two-tier board (also called a dual board). Ukraine has adopted a two-tier board structure: Ukrainian joint stock companies usually have a supervisory board and a management board. However, companies listed on foreign stock exchanges usually have one-tier boards in accordance with local exchange regulations. Among the WHU-50 companies, 35 (66%) have two-tier boards and 18 (33%) have one-tier boards. All banks and other state-owned enterprises have two-tier boards while all companies listed on foreign stock exchanges have one-tier boards.

In the case of the one-tier board, the Chairman of the board and the Chief Executive Officer can sit on the single board. In the two-tier board system, the supervisory board is led by the Chairman of the board and the management board is led by the CEO of the company. The average size of the two-tier boards in the WHU-50 is 6.5 while one-tier boards average 5.9 members.

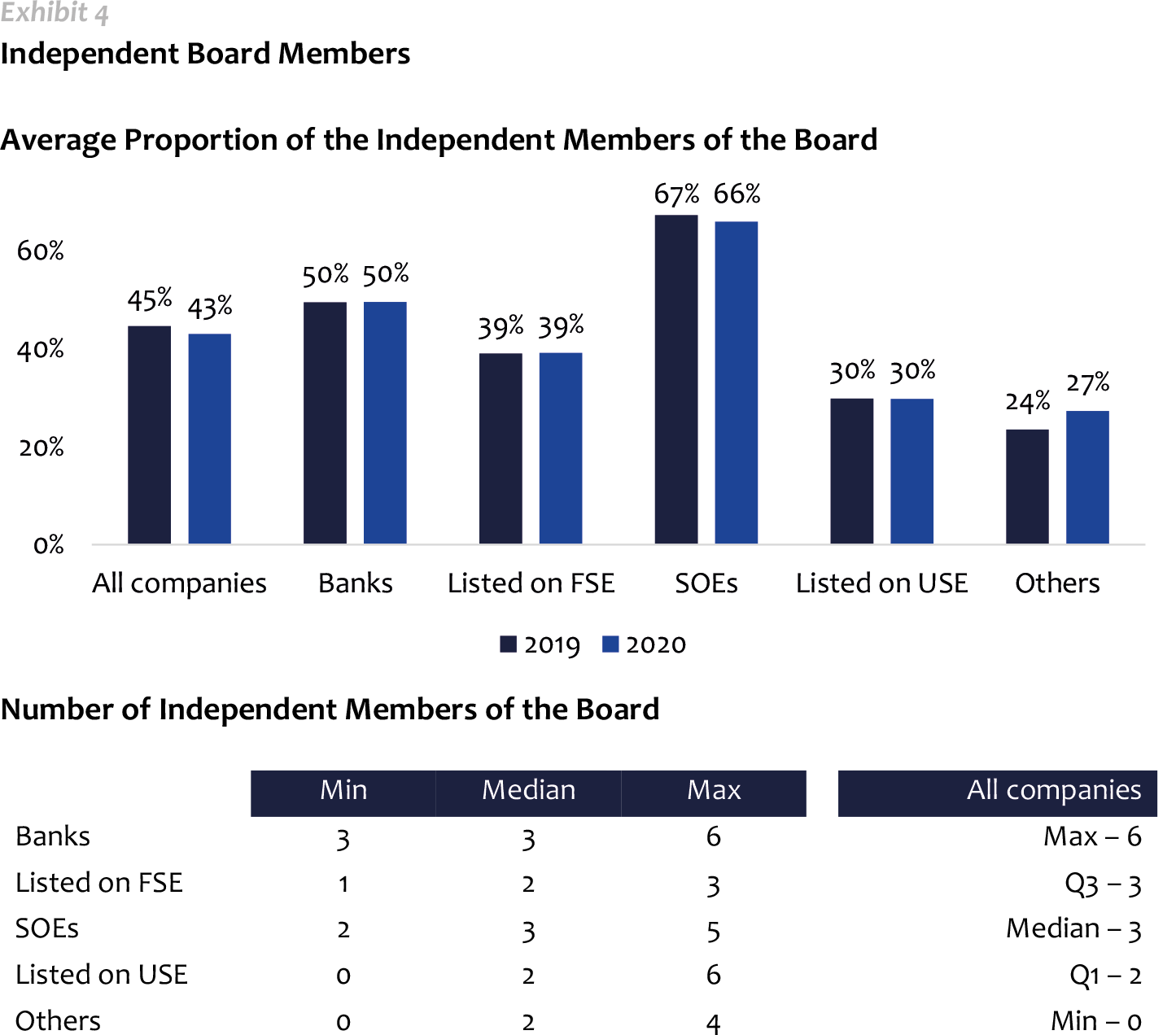

Independent Directors

Among all 335 board members of the WHU-50 in 2020, 144 members are independent (43%) and 191 are either shareholders or their representatives (57%). The percentage of independent board members shows a slight decrease from 45% in 2019.

For 2020 we show an increase in the percentage of independent board members in the group “Others” because we increased the size of this group by adding to 4 Eurobonds issuers two private Ukrainian companies (Kyivstar and Nova Poshta).

There has been a slight decrease of the percentage of independent board members among the SOEs. In the other companies the percentage remains unchanged.

As in 2019, for companies listed on Ukrainian stock exchanges, the average percentage of independent directors is much lower at 30%. The highest percentage of independent members is at state-owned enterprises (66%). Three companies have no independent board members and 22 companies have less than 3 independent members on their boards.

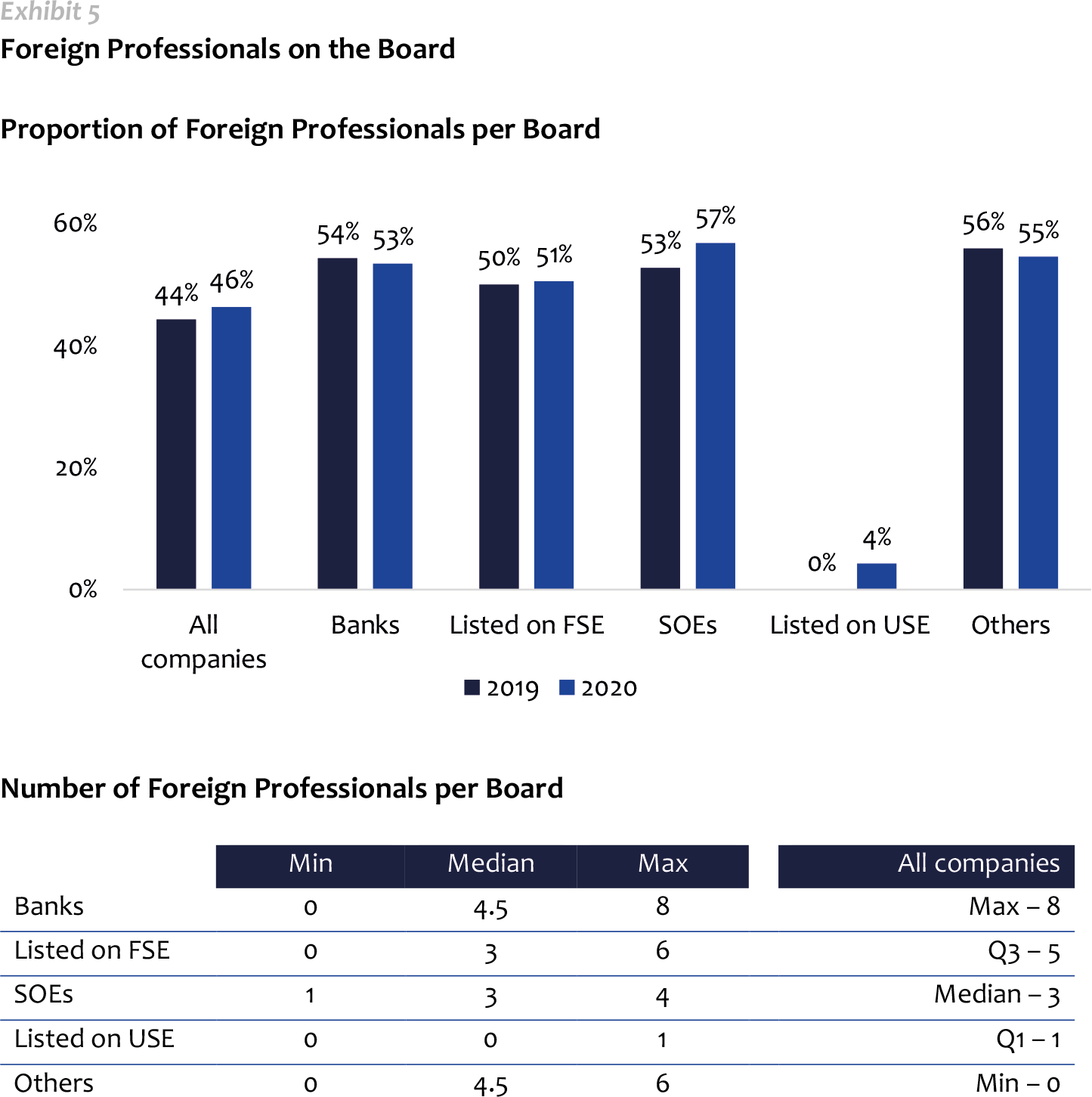

Foreign Professionals on the Board

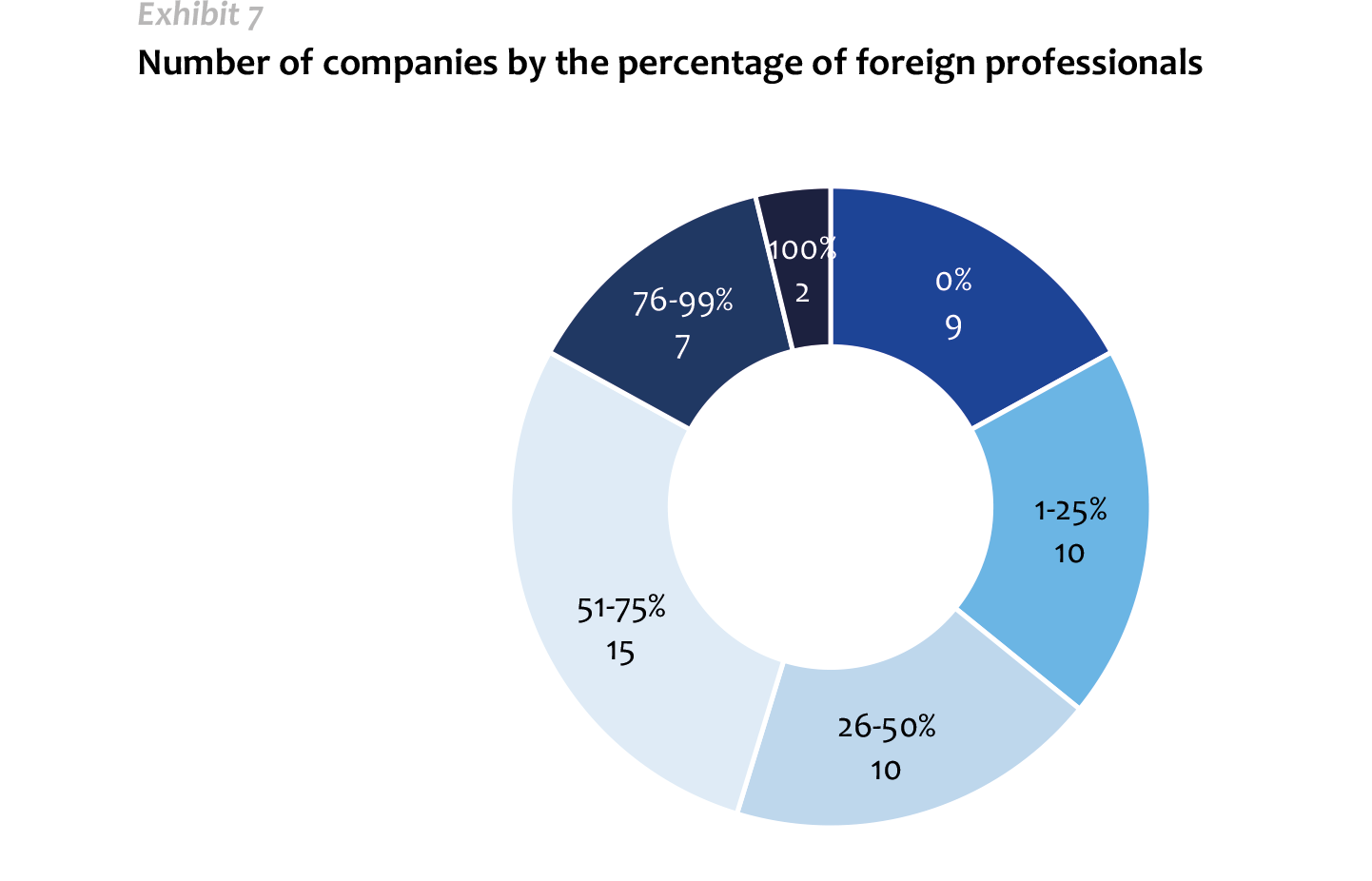

In 2020, the total number of foreign professionals on WHU-50 boards is 155 members, or 46.2% of the total amount slightly exceeding 44.3% in 2019.

In 2020 we found a slight decrease in the proportion of foreign professionals on bank boards while an increase was recorded among the SOEs. In comparing the group of companies among themselves, we see that the proportion of foreign professionals lies in a narrow range of 46-57% excepting the companies listed on the Ukrainian exchanges at only 4%.

In general, on the boards of the WHU-50 there are foreign professionals of 32 different nationalities not including Ukraine. The most widespread nationalities on the WHU-50 boards are United Kingdom, France, and the United States, relating both to all board members and specifically independent board members.

The largest number of foreign professionals on WHU-50 company boards is 8 and reaches 100% in 2 companies. At the same time, 9 companies of WHU-50 have no foreign professionals on their boards.

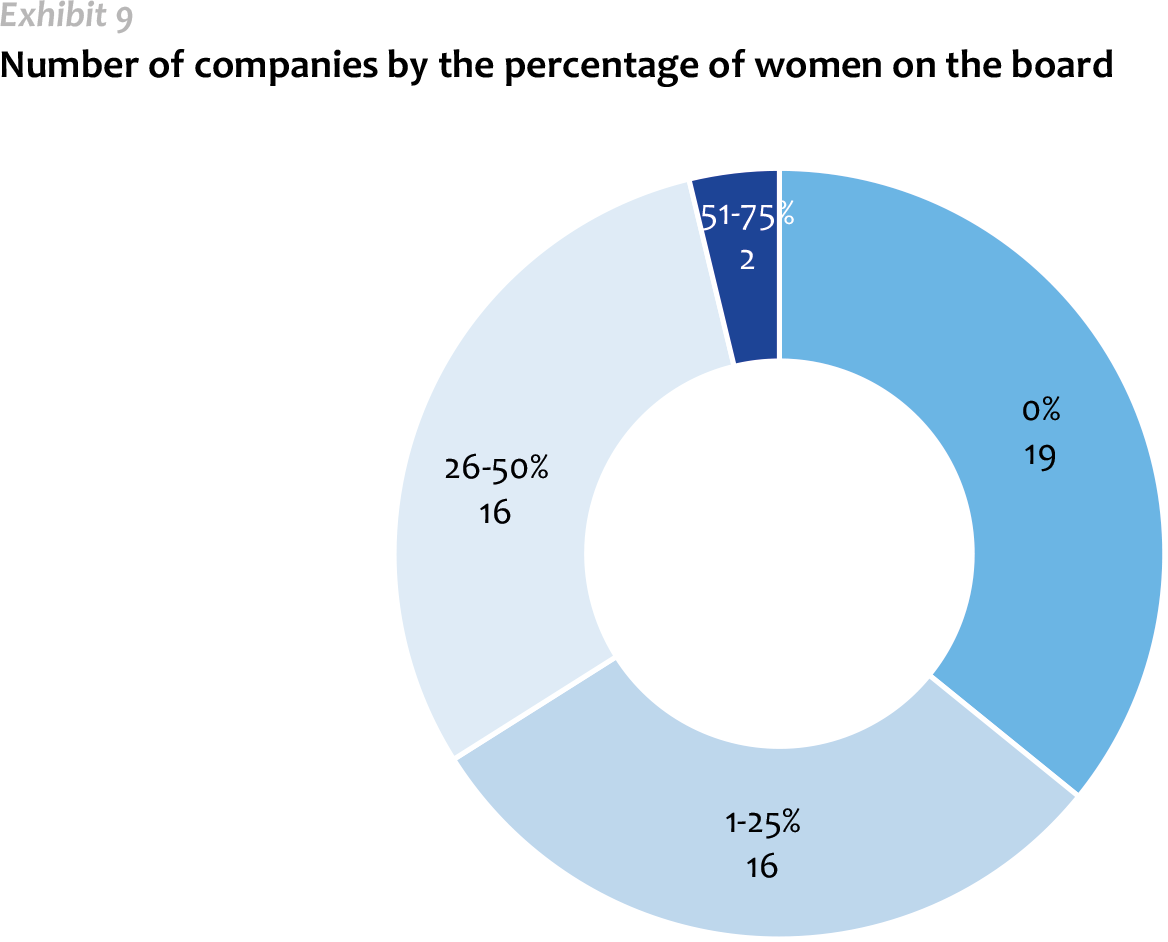

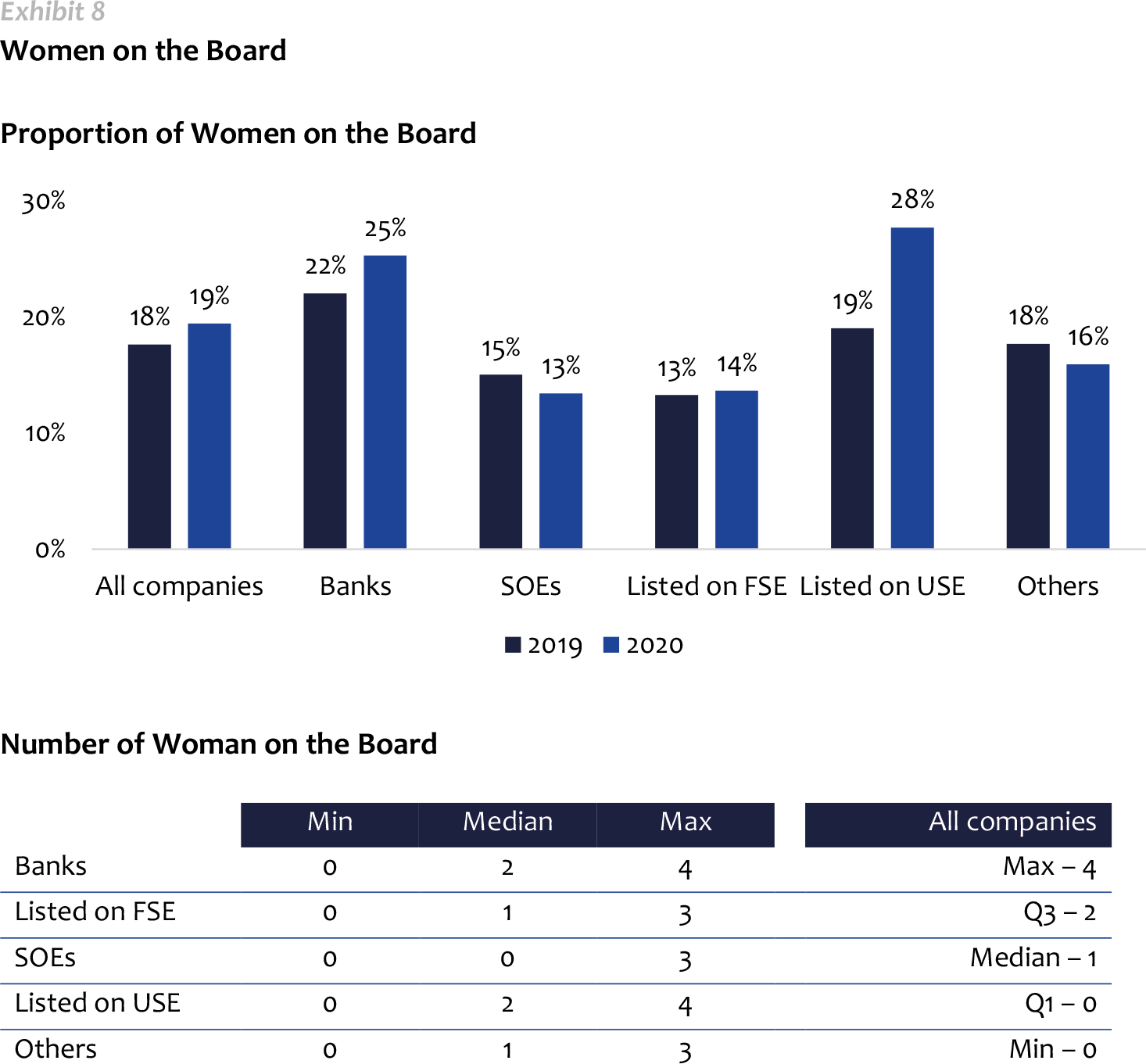

Women on the Board

The issue of diversity and particularly female representation on the board was the topic in last year’s edition of our study on which our readers commented the most.

Among all 335 WHU-50 directors, 65 are women or 19.4% compared to 17.6% in 2019. Banks as well as companies listed on Foreign and Ukrainian stock exchanges showed an increase in the percentage of female representation on the board. At the same time, state owned enterprises showed a slight decrease from 15% to 13%. The largest percentage of women on the boards in 2020 is found among companies listed on the Ukrainian stock exchange and reaches as high as 28%.

There are two companies among WHU-50 that have a majority of 60% of women on the board. There are three companies with half of the board comprising women. At the same time, there are still 19 companies out of WHU-50 with no female representation on the board.

When it comes to nationality of female board members, 49 out of 65 are Ukrainian. Also, there are 7 female board members with British citizenship and 3 female board members with American citizenship. In 2020 seven new female board members were appointed to the boards of the WHU-50.

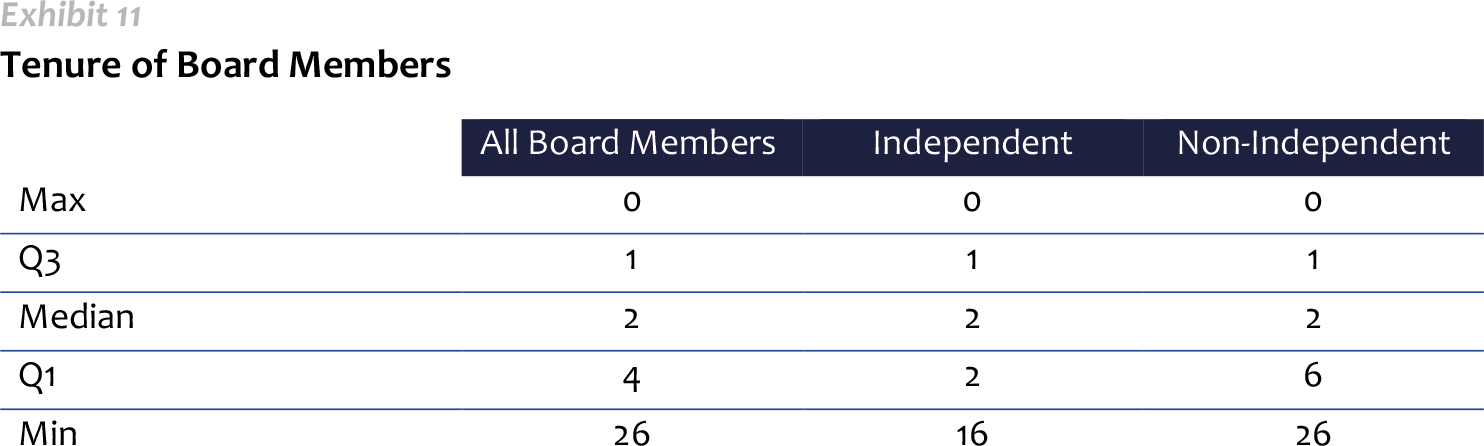

Some More Insights About WHU-50 Board Members

In total, 335 board members serve on the boards of 53 of WHU-50 companies. The vast majority of these directors were appointed in 2019. There are 20 directors that have served on their boards for more than 10 years. The longest board service has been 26 years. In the interval between 2010 and 2020 the smallest number of directors were appointed in 2015- only 5 new directors.

The average tenure of board members is 3 years. The average tenure of independent board members is 2.4 years while the average tenure of shareholder representatives is 3.8 years.

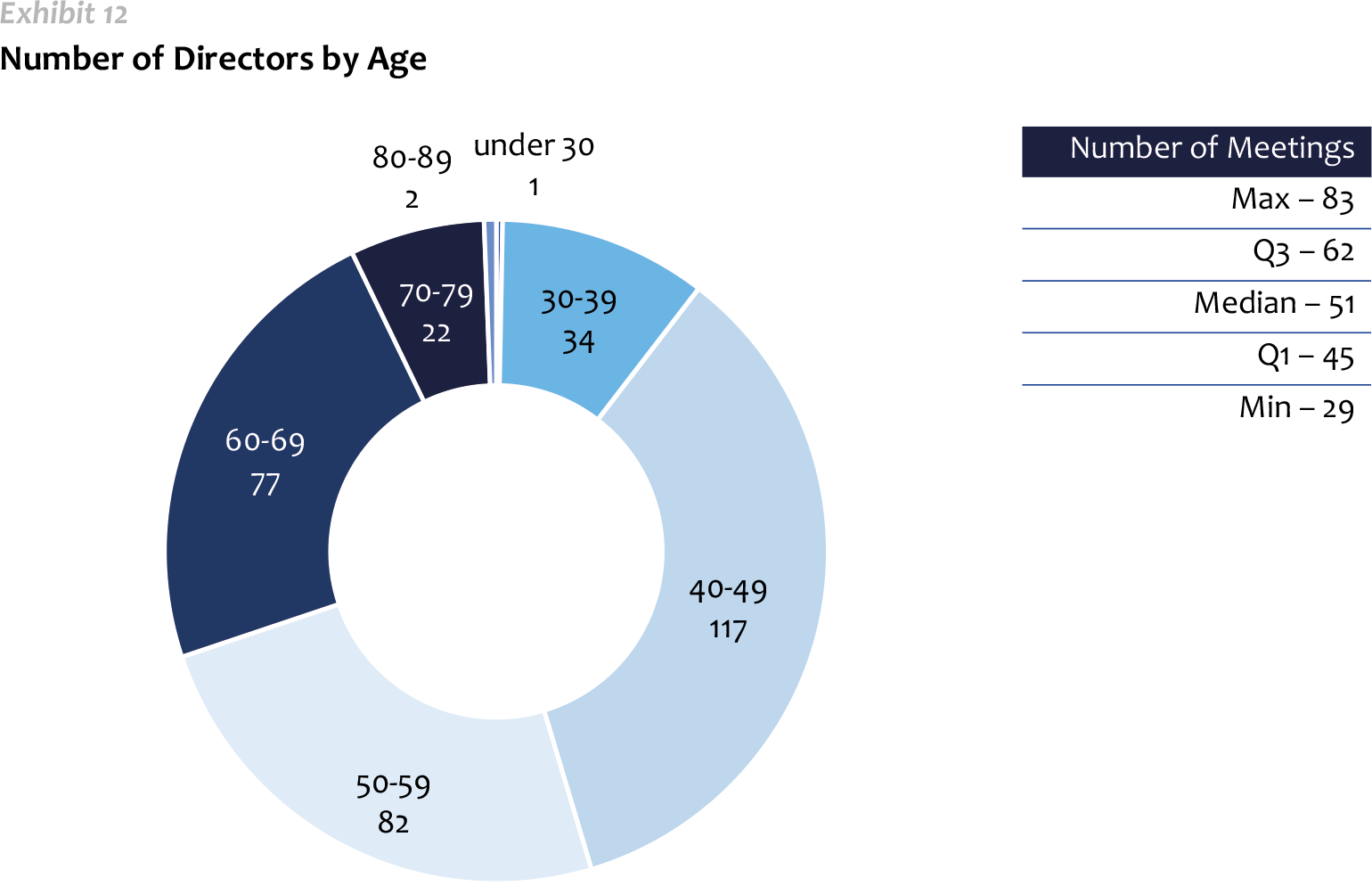

When it comes to the age of board members, the youngest board member is 29 years old while the oldest board member is 83 years old. The average age of the board member is 53 years old.

The majority of board members are between 40 and 49 years old. At the same time, there are 34 board members between 30 and 39 years old as well as 22 board members between 70 and 79 years old.

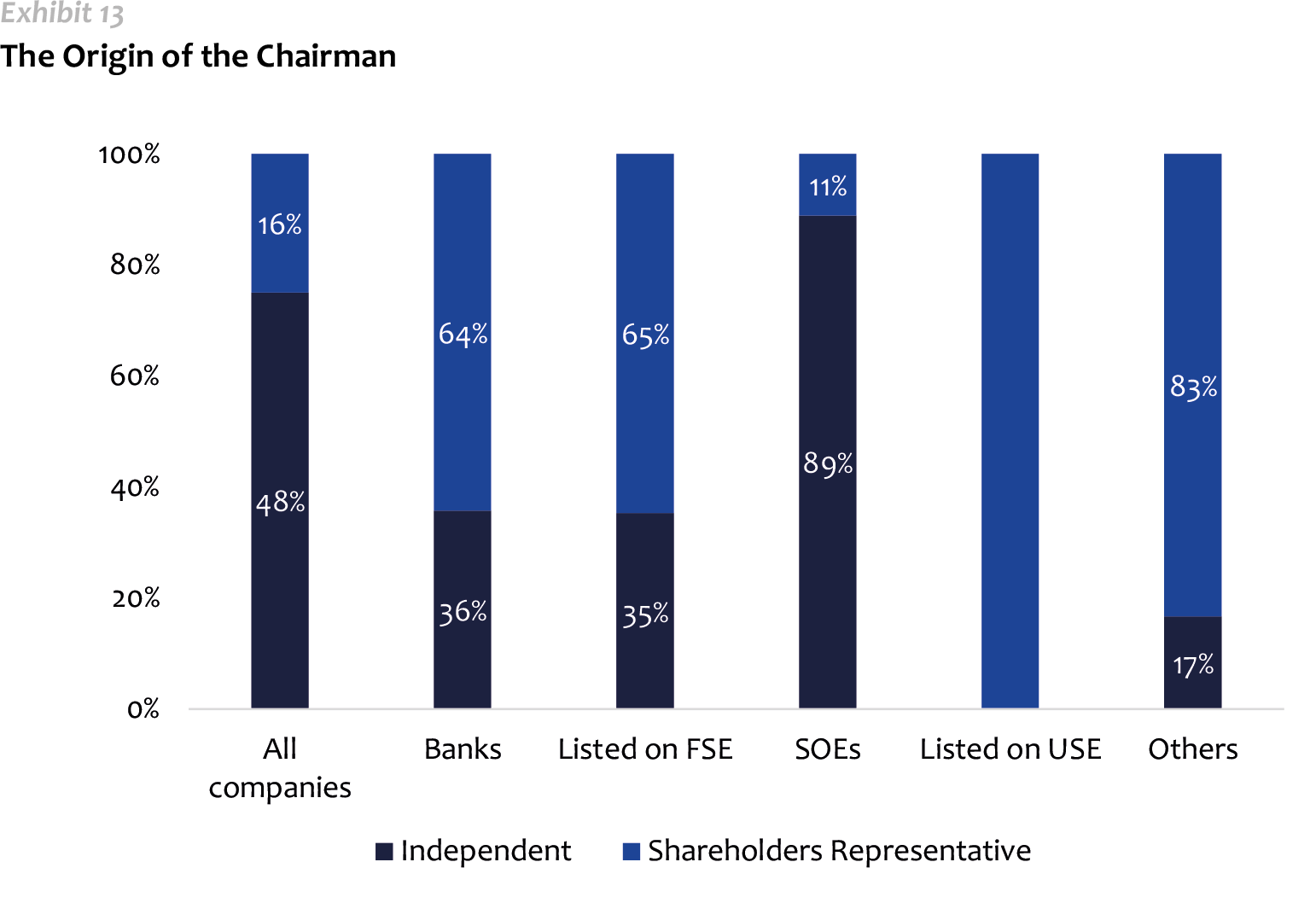

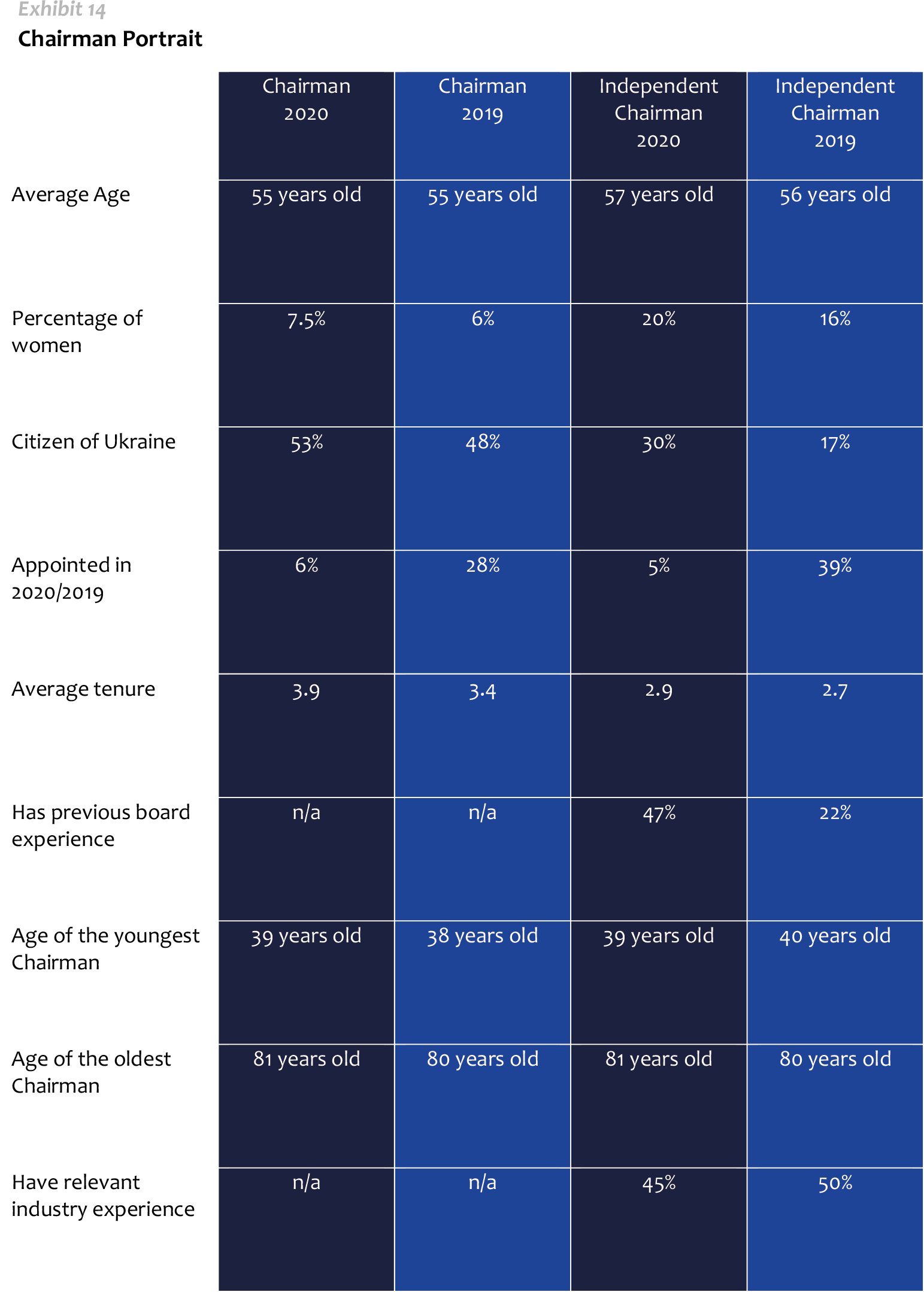

Chairman

The chairman of the board in 38% of the WHU-50 companies is an independent board member and in 62% is a hired representative of the shareholder or a founder of the company. There are 6 chairmen of the board who are the founders of the business.

Independent chairmen of the board tend to be present in state-owned banks and state-owned enterprises. At the same time, companies listed on the Ukrainian stock exchanges tend to nominate non-independent Chairmen – shareholder representatives.

There are three chairmen of the board who are seated on more than one WHU-50 board simultaneously.

Three new chairmen were appointed in 2020. There are four chairwomen of the board at WHU-companies.

The trend has slowed significantly, at least for now, since only 3 new chairmen were appointed in 2020 compared to 14 in 2019.

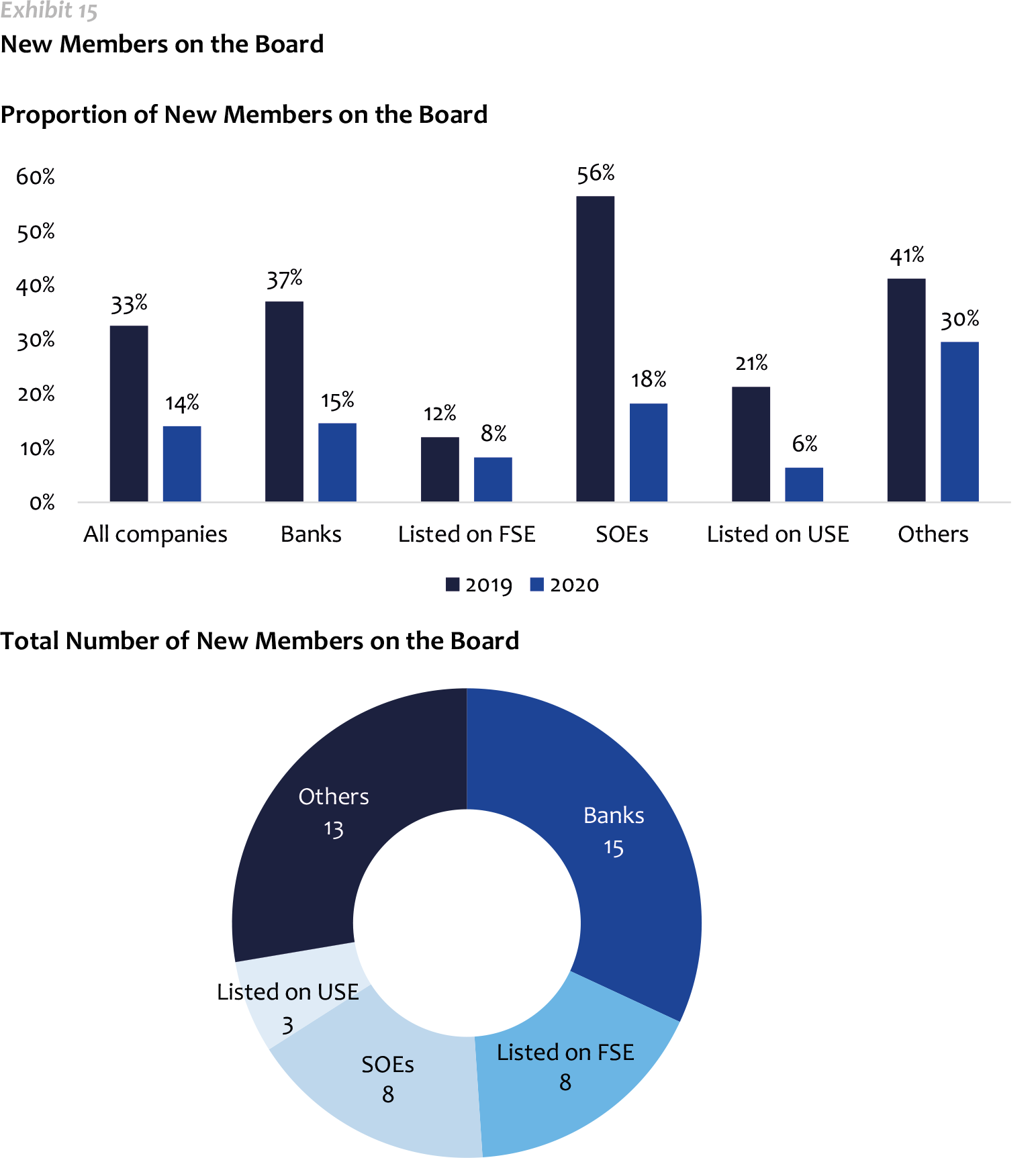

New Members on the Board

In 2020, 47 new board members were appointed to the boards of WHU-50 companies, or 14% of total board members. For comparison, in 2019, 104 new board members were hired, a total of 32.5% of all board members. Approximately double or even triple decrease of new hires took place at each group of companies under WHU-50 consideration. The largest portion of new appointments took place among banks.

Among the 47 newly appointed board members, 7 are women and 40 are men. The 22 of new board members have Ukrainian citizenship while 25 have foreign citizenship, including but not limited to the United Kingdom, Poland, Russia etc. Only 14 out of 47 newly appointed board members are independent.

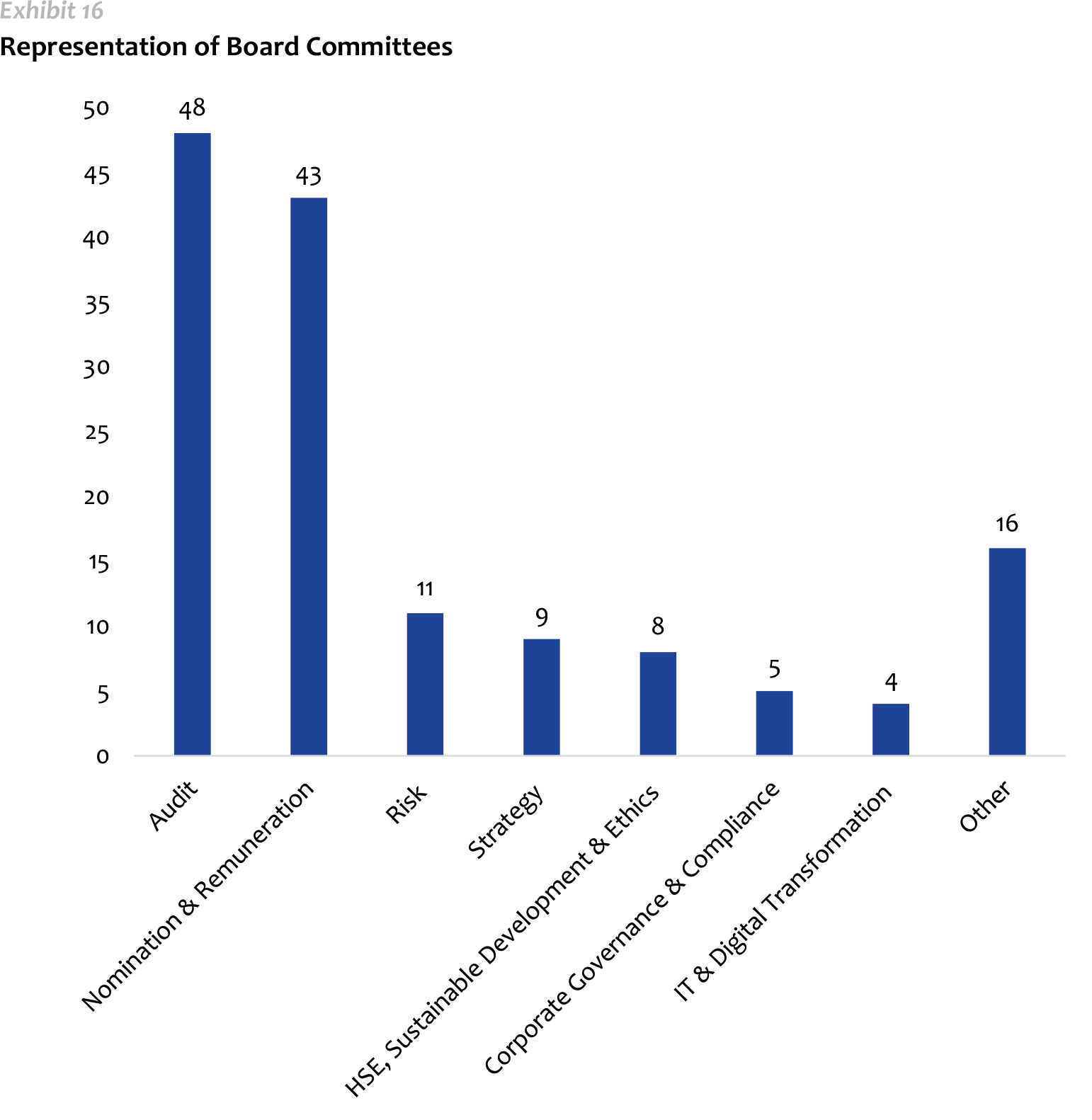

Board Committees

Among the 53 companies of WHU-50, three have not set up any committees as compared with 6 in 2019.

Audit and nomination & remuneration committees are still the most common. Forty-eight companies of WHU-50 have audit committees compared to 43 in 2019. At the same time, 43 have nomination & remuneration committees or remuneration committees only.

A risk committee is present at 11 of the WHU-50 companies although the risk function is often included under the Audit Committee. And strategy-related committees are present at 9 of the WHU-50 companies.

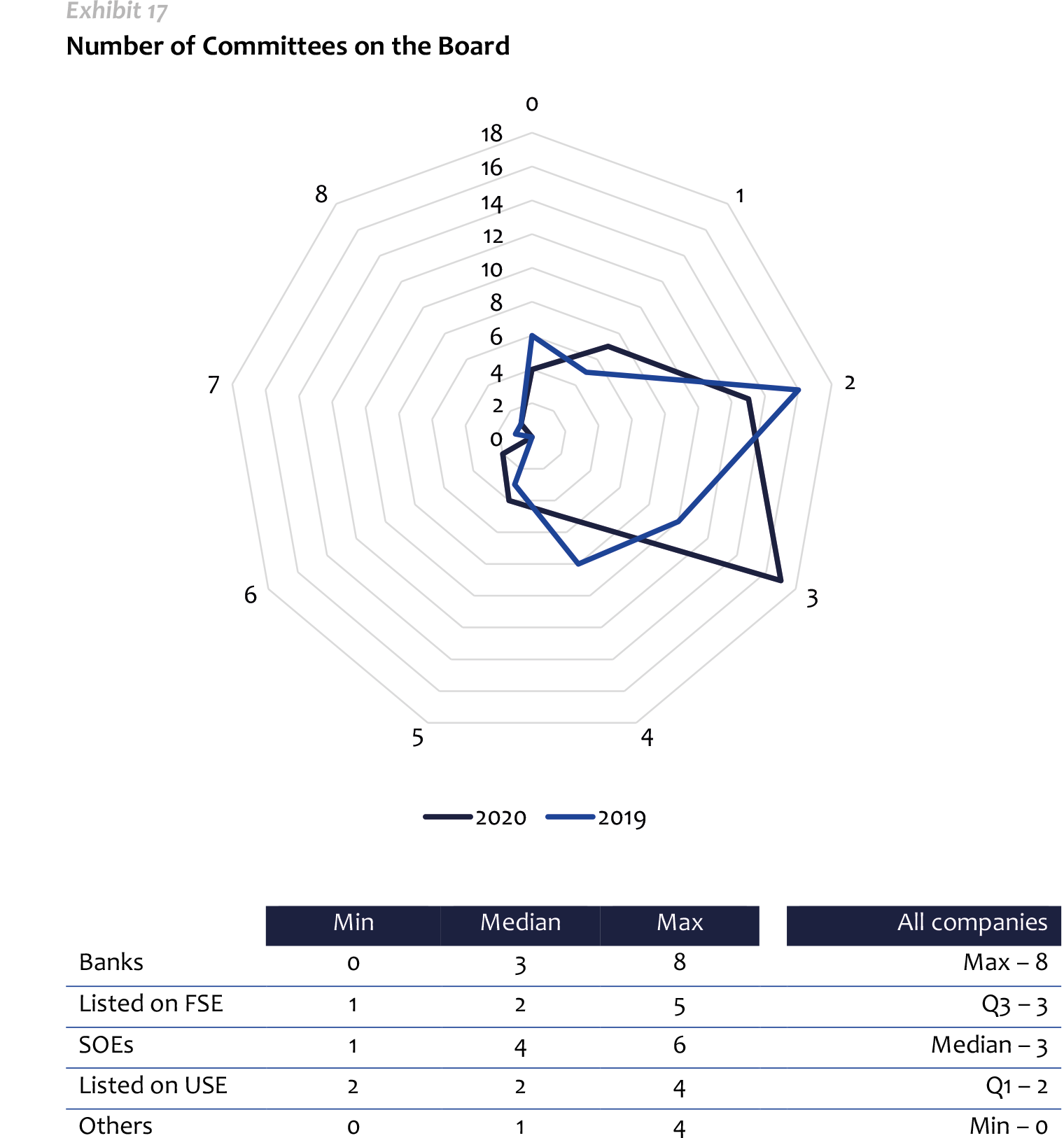

All WHU-50 companies have in total 144 committees with the average of 2.7 committees per board (2.6 in 2019). The largest number of committees is 8. State-owned enterprises as well as banks have the largest number of board committees.

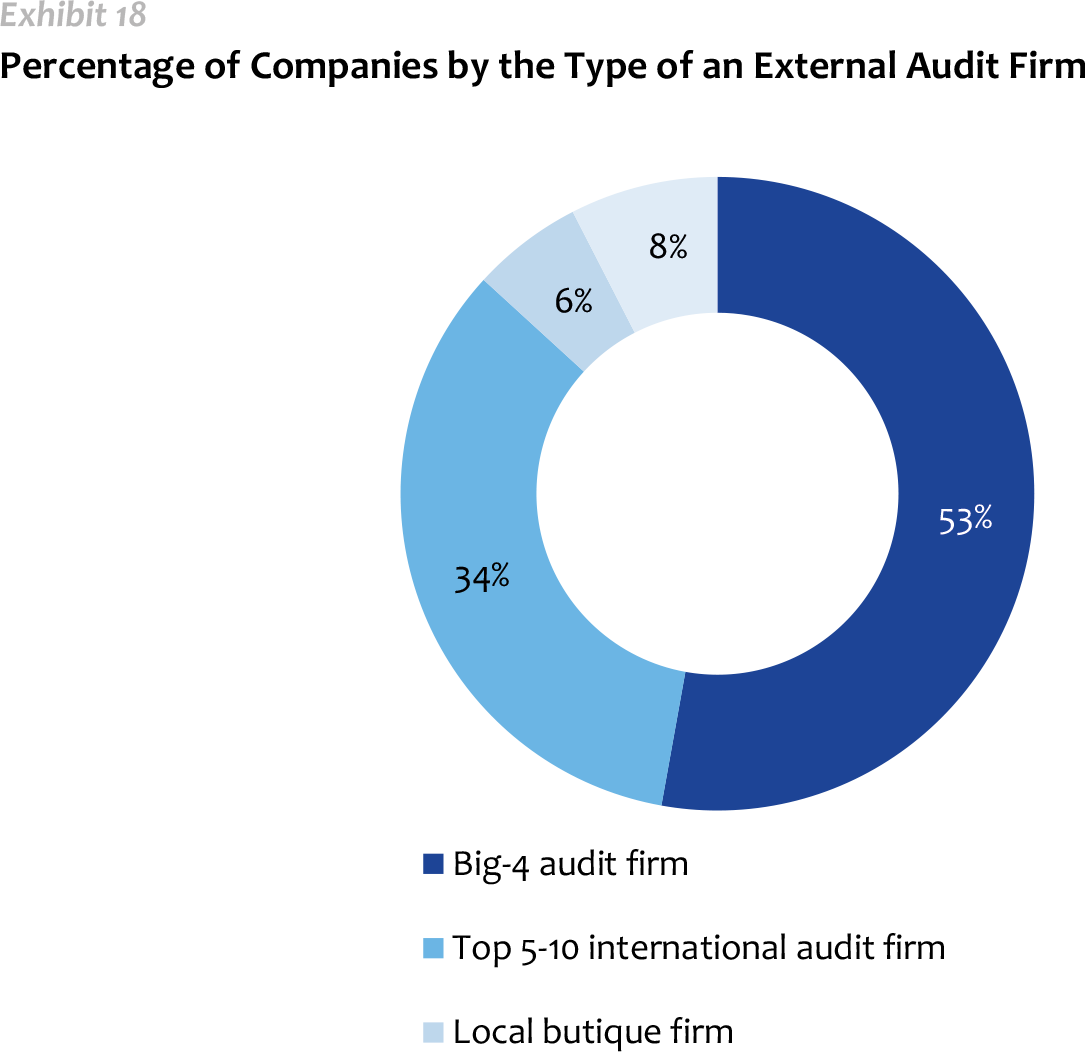

External Audit

External audit is one of key pillars of good corporate governance. Independent audit is one of the most important and effective ways to align the interests of executives and shareholders. Information about an external auditor should be presented at an annual report of the company.

Among WHU-50 companies almost all use services of international audit firms. Moreover, more than half of WHU-50 companies use the services of a Big-4 accounting firm. There are three companies which, opposed to multinational audit networks, use the services of a boutique firm, particularly those based in London or Paris. This situation is typical for companies listed on foreign stock exchanges because the auditing firms in the countries of listing. The most preferred audit firms are: EY (10 of WHU-50), Baker Tilly (9 of WHU-50), KPMG (8 of WHU-50), PwC and BDO (6 companies each) and Deloitte (4 of WHU-50).

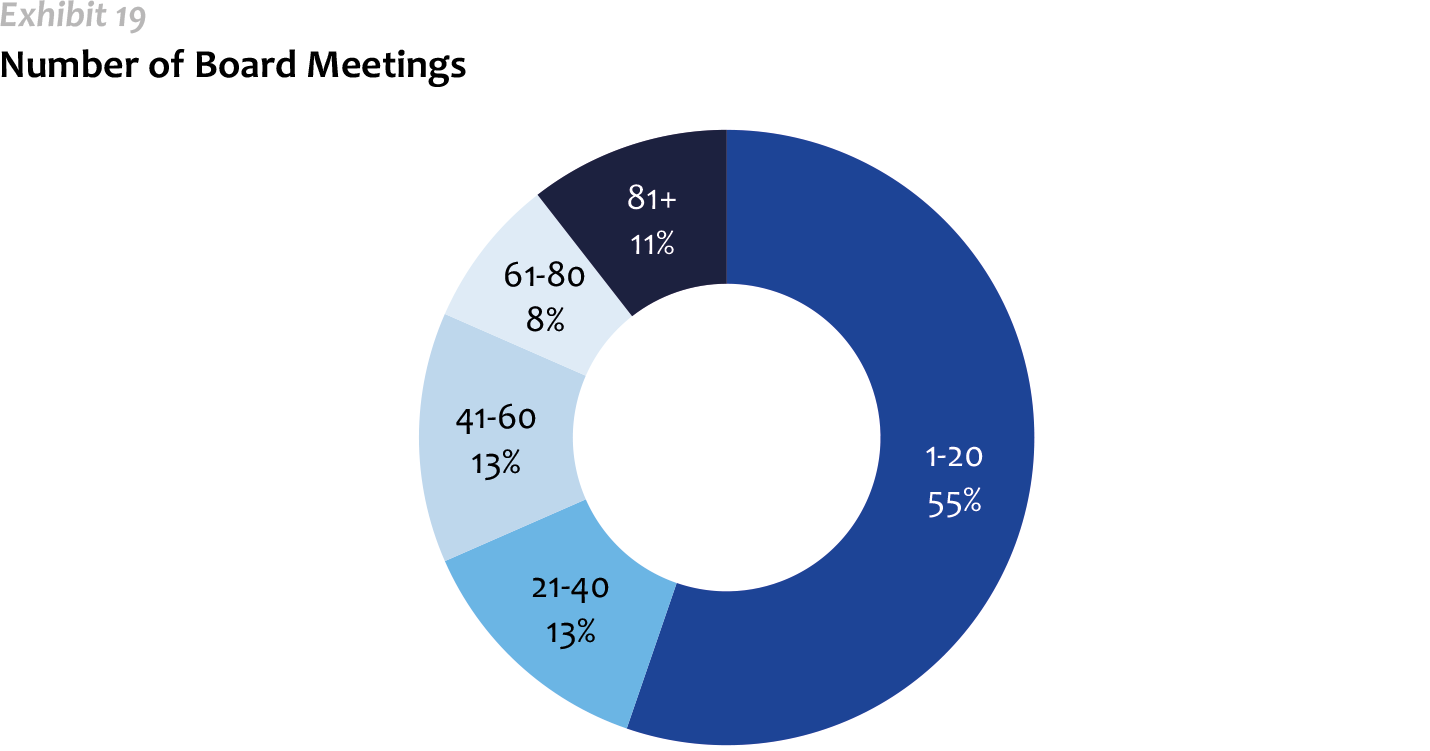

Board Meetings

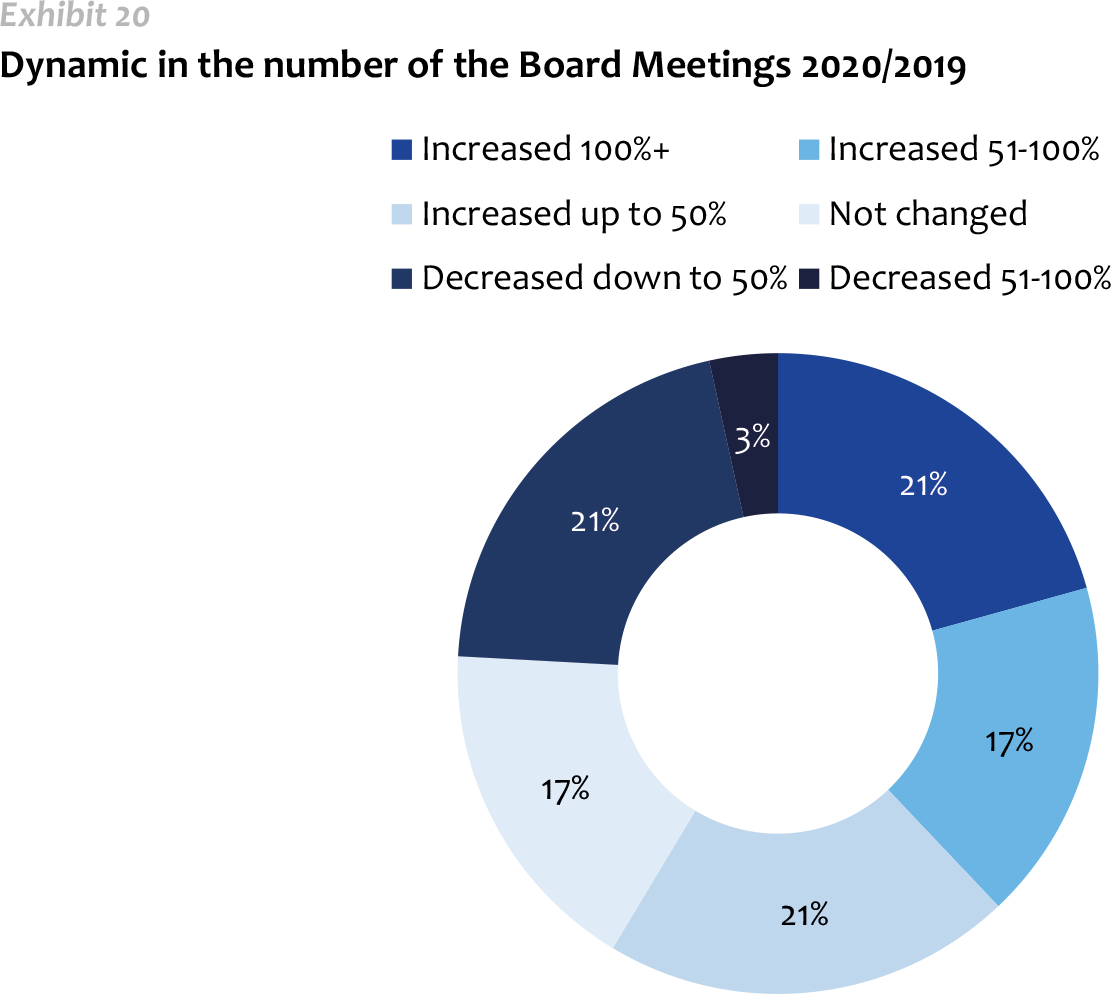

Based on the available information from 39 companies, the greatest number of meetings held in 2020 per company was 113 compared to 126 in 2019 (not at the same company). The smallest number of meetings was 4. The average number of meetings was 32 compared to 25 in 2019 and the median was 18 compared to 17 in 2019. The third quartile equals 48 while the first 8.5.

The majority of the companies (59%) have increased the number of board meetings in 2020 as compared to 2019. 24% of companies decreased the number of board meetings.

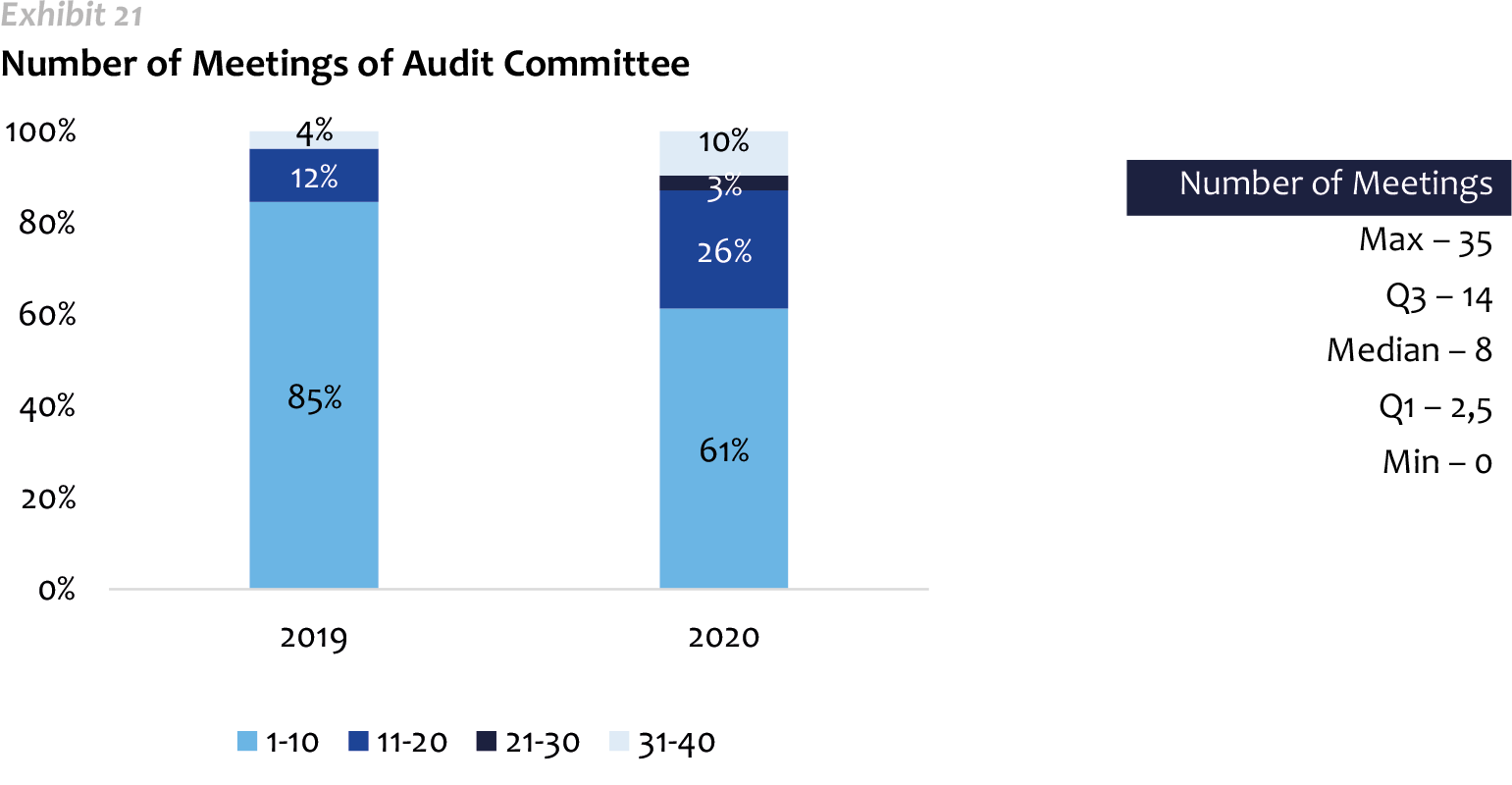

Committee Meetings

Based on the available information, the average number of meetings of the audit committee was 10.5 and the median 8. The maximum number of meetings of the audit committee was 35, the same as in 2019. At the same time, there are companies which, having established an audit committee, did not conducted any committee meeting in 2020.

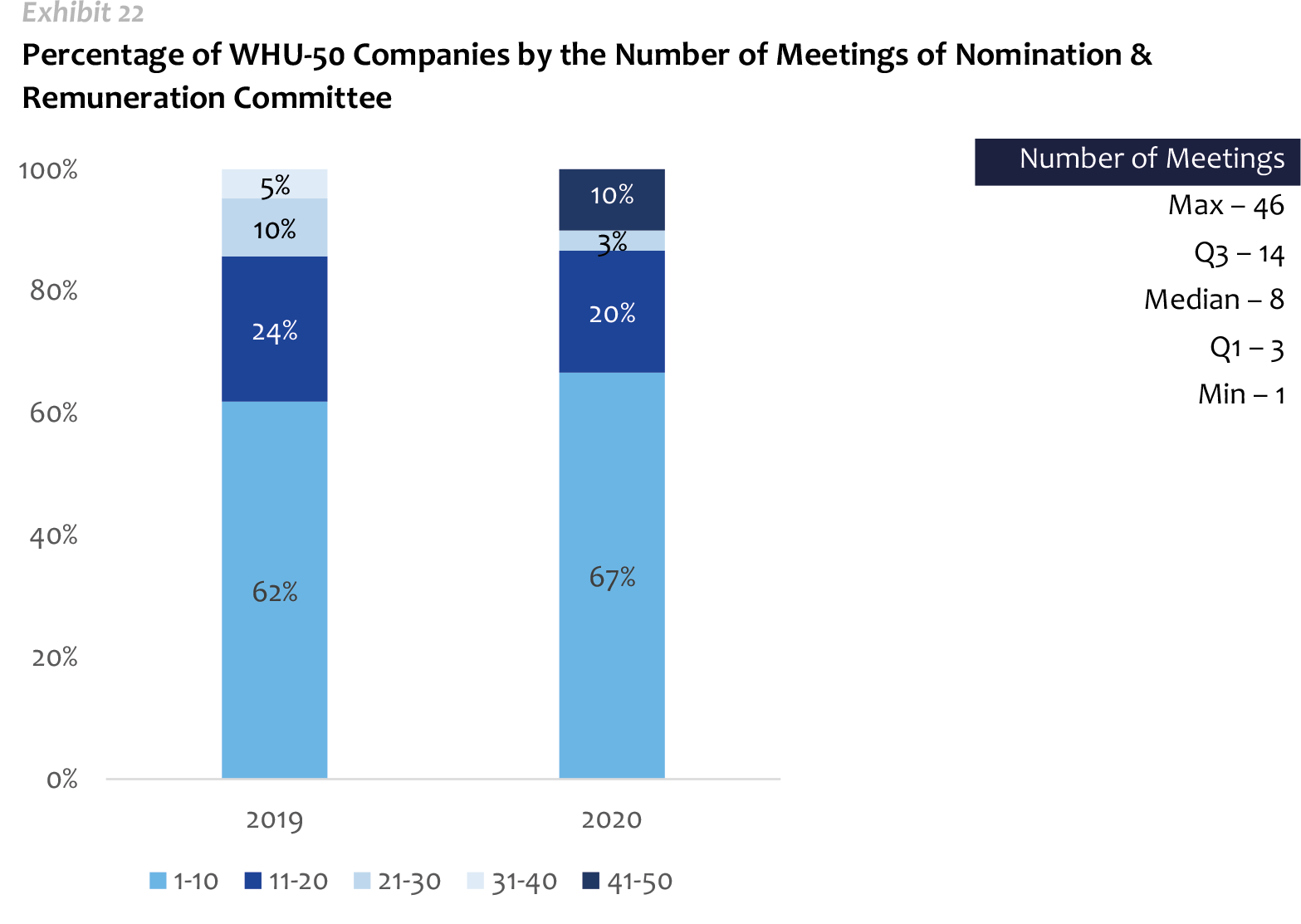

Based on the available information, the average number of meetings of the Nomination and Remuneration committee was 12 and the median 8. The maximum number of meetings of was 46 compared to 36 in 2019.

Chief Executive Officer

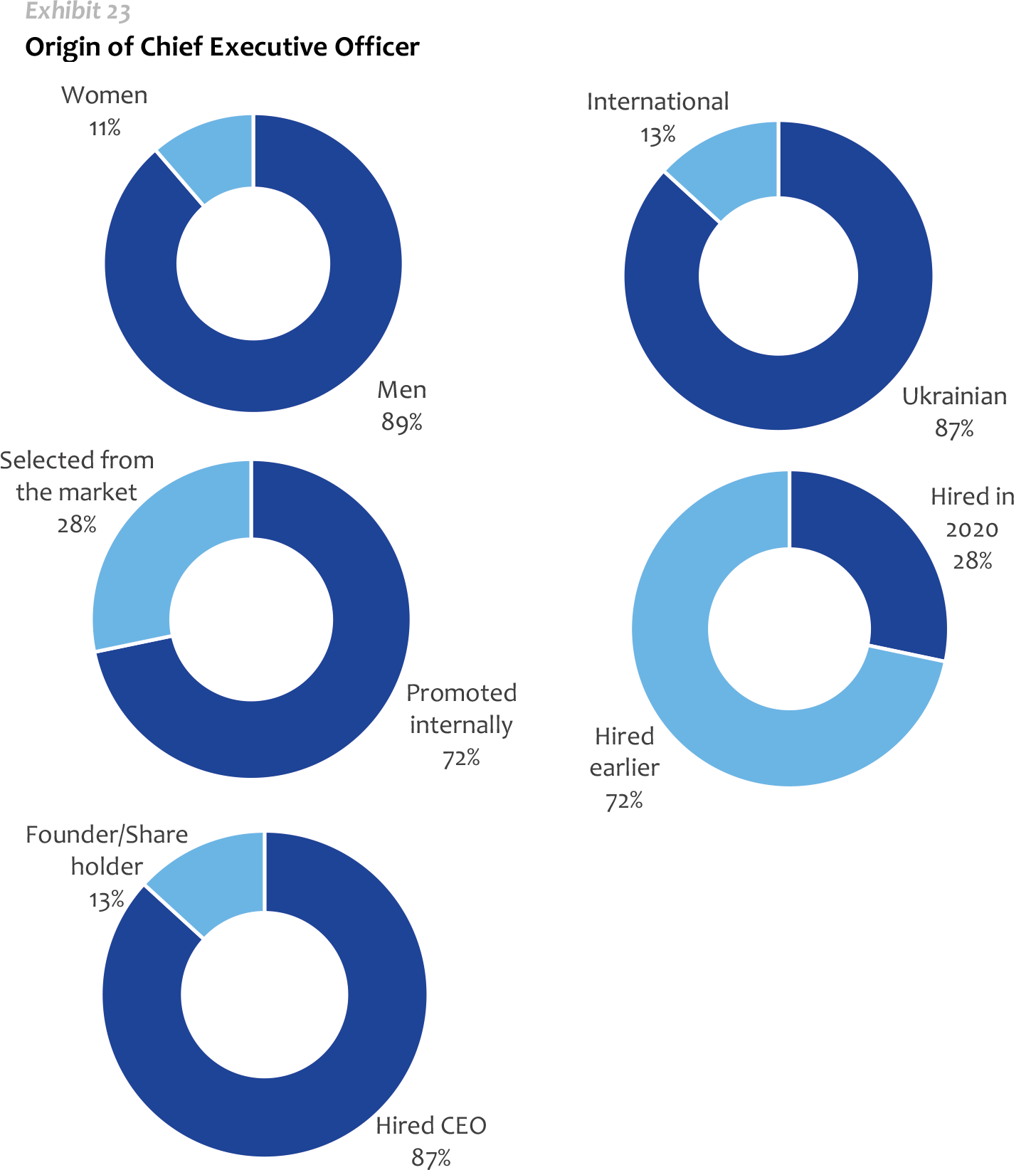

In 2020, 15 new CEO’s of WHU-50 were appointed compared to 9 new CEO’s in 2019. All newly appointed CEO’s are male. Among the 15 new appointments of 2019, 9 (60%) were promoted internally and 6 (40%) were selected from the market. In 73% of the cases, the CEO is Ukrainian and in 27% a foreign professional.

The average age of the CEO is 49 years old while lowest age is 33 and the highest 81. In our sample, 4 CEOs are under 40 years old and 6 CEO’s are 60 years old or older.

COVID-19 IMPACT

There is no doubt that COVID-19 has had an impact on the boards and corporate governance. Almost all WHU-50 companies outlined the impact of COVID-19 in their 2020 Annual Report or other relevant statements.

Particularly, the companies outline COVID-19 impact in the following areas:

Ward Howell

Ward Howell is one of the major global Executive Search and Leadership Development firms. We were founded in 1951 in New York City by the former head of McKinsey’s executive search practice, Henry Wardwell Howell, a pioneering management consultant who helped create the Executive Search profession. Today Ward Howell operates a network of 30 offices worldwide, is supported by over 130 partners, and is active in all major industry and services sectors.

Ward Howell Ukraine

Ward Howell opened its office in Kyiv in 2004 in order to support the rapidly growing demand for executive search services in Ukraine. Over the years we have built up an extensive network of personal contacts, especially among key executives and directors. We have also built within our firm an original research capability that rapidly and accurately identifies potential candidates at target companies specified jointly with our executive search clients. We serve a wide range of organizations in virtually every industry in Ukraine and the region. Our experience goes well beyond executive search to leadership development and board services. We help clients improve the effectiveness of their businesses through development and implementation of corporate governance systems, board effectiveness evaluation, and the acquisition, assessment, and development of board members.

Ward Howell Ukraine Leadership Institute

The Ward Howell Ukraine Leadership Institute is a proactive initiative to develop a knowledge-based approach towards research in Ukraine. The Institute was founded in 2019 to promote extensive research on corporate governance and leadership development. The Ward Howell Ukraine Leadership Institute conducts regular research on fundamental themes and developments as well as special research on newly developing topics of the day. The Institute also supports a data-driven approach to the conduct of executive search and consulting projects by Ward Howell Ukraine.